For businesses that are running successfully, it’s essential to keep a record of all their sales and purchases in a proper format, in order to move in the under lying requirement of the newly implemented GST Act. Most of this includes the legal duty to entrepreneurs to present the accurate figures of their business to the regulating authorities for the taxation purpose. Every nation follows different tax policies and business owners need to file their accounting report as per the guidelines of the general taxation rule.

The most commonly used indirect tax system throughout the world is GST. The Goods and Services tax is charged on the every commodity at one time according to the rate decided by the government. The businessman and traders need to calculate tax as per the given rate and present their annual taxation report to the tax department.

Nowadays everything is going digital and so is the bookkeeping process. Well, every business organization either small or big has to maintain their accounts on a system. To keep accounts digitally, the business owners required an expert accountant and also a useful accounting software. Every taxation system has their own kind of unique software system to support its functioning.

Best GST Accounting Software (Free/Paid) in India

So, if you are looking for the perfect GST software for your organization which will help you to enhance the performance of your business, then please read the full list below. Here, we have mentioned the best software for GST as per your budget, and you can select the best one based on its pros and cons.

Benefits of Using GST Accounting software:

1. The GST software provides the flexibility to the users to easily make alterations in the accounts with one simple click of a finger. In the manual system, it’s challenging to maintain the errors without making the mess.

2. The using software will reduce the work load on an accountant, as by entering one transaction other accounts will be automatically generated.

3. The mistakes and errors can be avoided by using the digital system to get into the accounting data.

4. The software is easy to use and designed to help the people. Using GST software will fasten the work process, and more output can be achieved in the less time.

5. The auditing process can be easily performed if the accounts are digitally maintained and finding the errors become easier for the auditor.

All in all using GST software has numerous benefits, and every emerging business owner must invest in the high performing GST software, so let’s find out some decent GST software plus their price range and features.

#GST Softwares Priced Below 5K:

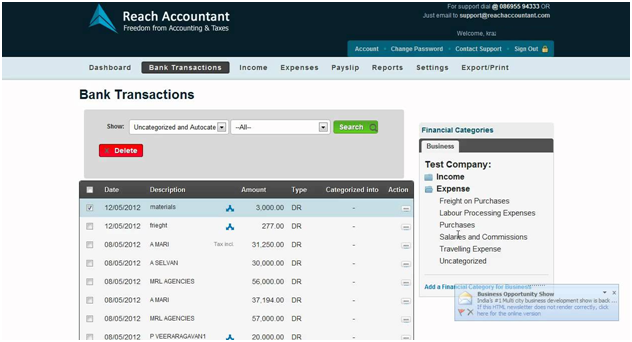

1. Reach Accountant (Best Software for the GST Taxation)

The top of the list is Reach accountant GST software, which is loaded with the all right elements of the perfect GST software. The Reach is very user-friendly and preferred accounting software for the GST taxation. The software is brilliant and can be easily customized by the users according to the business needs and requirements.

The top of the list is Reach accountant GST software, which is loaded with the all right elements of the perfect GST software. The Reach is very user-friendly and preferred accounting software for the GST taxation. The software is brilliant and can be easily customized by the users according to the business needs and requirements.

The Reach comes in a full performing package and assists the user in taking better decisions. The software tells the perfect situation of the business and also provide timely updates if any required. The Reach is a multitasked software which performs plenty of functions, such as accounting, inventory, tracks expenses, multi branches, automatic accounting, filing reports and another bundle of features.

Price of the Reach Accountant;

- GST Filing Software: ₹ 150/- per filing (Free Software, Pay only to File)

- GST Accounting Software: ₹ 6000/- (Annual Renewal 20% off)

- 15 days free trial is also available for the GST software.

GST Related Features of the Reach Accountant;

- GST Invoicing

- HSN/ SAC Code Mapping

- GST Computation

- Auto Reconciliation from GSTN

- GST Challan Generation

- Free e-learning

- GST Payment

- Filing (GST)

| Pros | Cons |

| √ It Informs you about the GST bills uploaded by your suppliers each day. |

⊗ The perfect GST software has only one significant disadvantage that it cannot operate without a reliable internet connection. |

| √ Reconciles GST every day. | |

| √ Raises GST Invoices. | |

| √ Maps GSN Codes. | |

| √ Fully Cloud based so saves expensive Investment in servers. | |

| √ The free version can be easily upgraded. | |

| √ Hard disk crashes don’t affect data. | |

| √ The tailor made for the every business. |

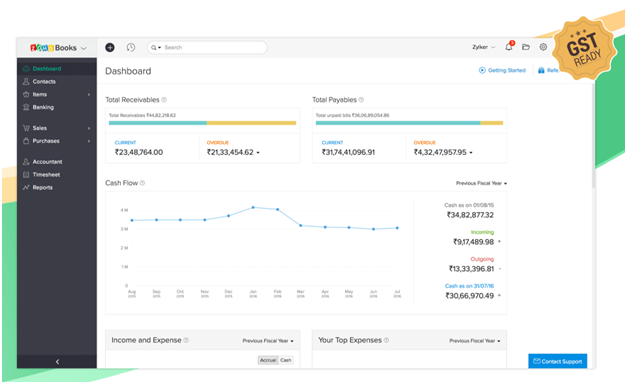

2. Zoho Books (User-Friendly GST Software)

A straightforward and simple software to handle all your GST related data in one swift movement to make the life super easy. The Zoho is very user-friendly software and can be easily dealt with by the beginners also. The software also has a mobile app which enables business owners to stay up-to-date every time, and they can easily access their GST data from their mobile phone.

A straightforward and simple software to handle all your GST related data in one swift movement to make the life super easy. The Zoho is very user-friendly software and can be easily dealt with by the beginners also. The software also has a mobile app which enables business owners to stay up-to-date every time, and they can easily access their GST data from their mobile phone.

The price of Zoho books:

- The Zoho books can be your for 2500 per year.

- The Annual renewal is 100% possible.

Fantastic Features of Zoho Books:

- The Zoho has a mobile app.

- Can handle all accounting functions.

- The cloud storage is possible.

| Pros | Cons |

| √ It has Fully Cloud based storage facility. |

⊗ Internet connection required to work on it. |

| √ Hard disk crashes don’t affect data of account. | ⊗Not more than 7 users can operate on it. |

| √ No Anti-virus software needed. | ⊗ Branch consolidation is not possible. |

| √ Free Version Upgradesis available anytime. | ⊗ Lacks some main features. |

| √ Fully Cloud based so saves expensive Investment in servers. | ⊗ No inventory management function. |

| √ Self-customization to some extent. | |

| √ The low price of the Zoho is its main attraction. | |

| √ Loss of using ZohoBooks: |

3. Quick books (₹ 5000 – Best Accounting Software under 5000)

Like the name of the software suggests, it quick and fast to handle all your GST burden and make your life smooth. The Quick books have a user-friendly and fast interface that can work at an extreme speed for you.

Like the name of the software suggests, it quick and fast to handle all your GST burden and make your life smooth. The Quick books have a user-friendly and fast interface that can work at an extreme speed for you.

The software can file tax and reports for the business efficiently. The natural interface of the software is the main highlight of it.

Price scheme of the Quick books:

- This Super simple software can be yours for only ₹ 5000

- The annual Renewal is possible at 100%.

Features:

- The software comes with the mobile app.

- Accounting data can be easily stored in the mobile phone.

- The cloud storage is also possible in the Quick books.

| Pros | Cons |

| √ Fully Cloud based |

⊗ Internet connection required to work on it. |

| √ Hard disk crashes don’t affect data | ⊗ Notmore than 7users can operate on it. |

| √ No Anti-virus software needed. | ⊗ Lackssomemainfeatures. |

| √ High control over data | ⊗ Noinventorymanagementfunction. |

| √ Free Version Upgrades | |

| √ Low price |

4. GEN-GST (Best GST Software for Accounting Service )

The best software to dive into the details of the GST and provide your clients quality work. The person who is not familiar with the trends of GST definitely gets this software which will solve their all GST related issues. The software is a blanket for all the GST requirements and provides quality information in filing the return, as per the guidelines.

The best software to dive into the details of the GST and provide your clients quality work. The person who is not familiar with the trends of GST definitely gets this software which will solve their all GST related issues. The software is a blanket for all the GST requirements and provides quality information in filing the return, as per the guidelines.

The price of GEN-GST:

- The this-superb Gst software will be yours for only ₹5000.

Features held by GEN-GST;

- Preparing GST reports.

- Filing GST data.

- Import and export of data.

The advantage of GEN-GST:

- The primary benefit of GEN-GST is that it works without internet connection.

Disadvantages of GEN-GST:

- Not an Accounting Software.

- No business related features.

- It’s only a disjointed tax preparation tool.

- Susceptible to Hard-disk crashes.

- Secure Data theft.

- Susceptible to Virus Attacks

- Version upgrades might be charged.

#GST software priced above 5K

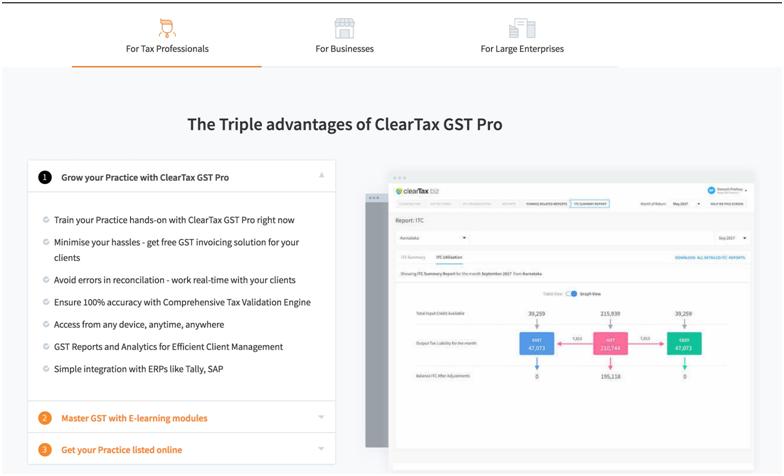

1. Clear Tax (Software fo Handle all the Accounting Functions)

The straightforward GST software for the accounting guys to understand all rules of the GST. The software is a direct and perfect tool to learn the GST. The software is able to handle all the accounting functions and also is a complete guide to learning the GST. This software provides you the free GST lessons and helps in finding new potential clients also.

The straightforward GST software for the accounting guys to understand all rules of the GST. The software is a direct and perfect tool to learn the GST. The software is able to handle all the accounting functions and also is a complete guide to learning the GST. This software provides you the free GST lessons and helps in finding new potential clients also.

The price of Clear Tax:

- This software is bit costly and will be yours for ₹10000.

Features provided by Clear Tax:

- Best to prepare GST.

- Business related functions.

- GST filing.

- GST lessons.

- Cloud storage.

The advantage of Clear Tax:

- Online Solution for any problems.

- Accountant gets registered listing.

Disadvantages:

- Not an Accounting Software.

- No business features available.

- It’s only a disjointed tax preparation tool.

- No business specific features Clear tax has.

- Can be used by accountants only.

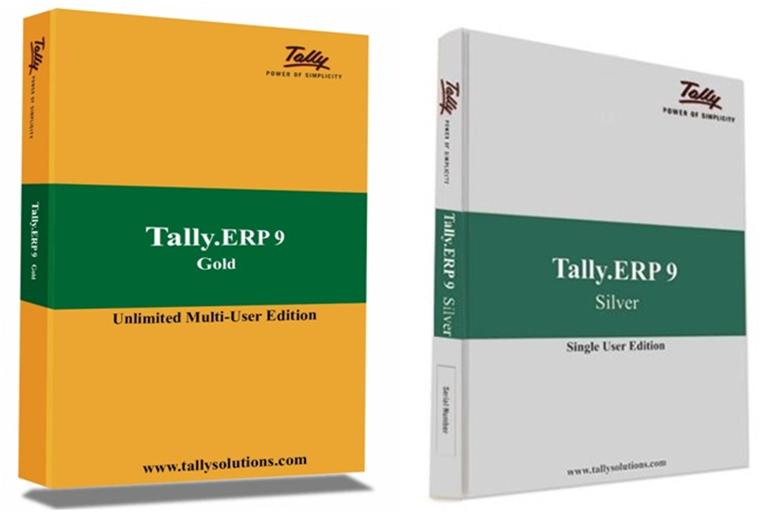

2. Tally ERP 9 ( Best Software for Accounting Data)

The father of all accounting software and most used accounting software is a Tally ERP 9. Every big or small enterprise is using this software to manage their accounting data. The Tally ERP 9 is power packed with the numerous features, and thus it is the first choice of every business institutions. The software is perfect to enter the world of GST and transfer your all data towards the GST.

The father of all accounting software and most used accounting software is a Tally ERP 9. Every big or small enterprise is using this software to manage their accounting data. The Tally ERP 9 is power packed with the numerous features, and thus it is the first choice of every business institutions. The software is perfect to enter the world of GST and transfer your all data towards the GST.

Price range:

- This is the most expensive accounting software in our list which will cost you ₹ 21,780 for Single User.

- Multi-user need to spend₹65,340.

- Annual Renewal of 25%.

Amazing Features of Tally ERP 9:

- HR and payroll.

- Investment.

- Multiple companies.

- Financial management.

- Inventory management.

- Invoice.

- Product database.

- Supplier and purchase order management.

- Taxation management.

Benefits:

- The software can work without internet connection.

- Accountant friendly.

Loss of using Tally:

- Needs LAN to operate multi-user

- Needs Tally.net + Static IP to work multiple locations

- Only professional can use it.

- Secure data theft.

- Up gradation of version is expensive.

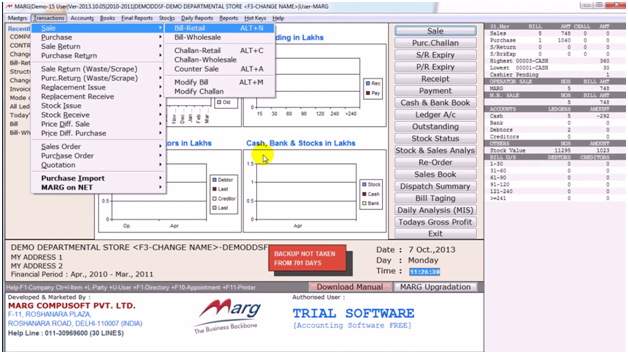

3. MARG ERP 9+

This is a software with high demand and high performing quality known as MARG ERP 9+. MARG ERP 9+ is currently trending in the India, and as it offers GST support, after GST, this is the only software which is mostly used by accountants.

This is a software with high demand and high performing quality known as MARG ERP 9+. MARG ERP 9+ is currently trending in the India, and as it offers GST support, after GST, this is the only software which is mostly used by accountants.

The software has all the required tools that you need to understand the working of the GST and this software will provide you, one satisfied client, for sure.

The software has all the required tools that you need to understand the working of the GST and this software will provide you, one satisfied client, for sure.

Price:

- This software is less expensive than Tally ERP 9; single User can get it for ₹7,200.

- And the Multi-users need to spend little extra ie ₹25,200.

- The Annual Renewal is done at 40%.

Features of MARG

- The inventory management accounting functions.

- The invoices can be easily generated.

- Different variable rates are available.

- Different excise duty rates can be easily applied in the MARG ERP 9+.

Advantage:

- An active internet connection is not required to work on it.

- The software is less expensive than Tally.

- The business oriented features.

Disadvantages:

- Needs LAN to operate multi-user.

- Needs investments in the server to operate multi-location.

- Very difficult to learn and perform.

- Data is not real-time.

- Susceptible to Hard-disk crashes.

- Secure Data theft.

- Susceptible to Virus Attacks.

- Version upgrades are charged.

- Prices increased recently.

Final Verdict:

So, I hope all the concerned folks, who are concerned about GST operations are now satisfied after reading the list of the available GST software. This GST software is here to help you and give you more time to enhance the performance of your business. So, guys invest in any of the above given GST software according to your budget and leave all your financial worries to them.