If you’re interested in trading stocks, then you might be wondering what the most popular Stock Trading Bots are. This article discusses 6 of the best-automated trading bots and how they can help traders make money while they sleep.

There are plenty of automated trading systems out there, but I’ve chosen only a few for this article.

I’ve also ranked each trading bot on a five-star scale since people are obviously going to want to use the best one.

Introduction to Stock Trading Bots

1. A stock trading bot is a computer program that automates the buying and selling of stocks.

2. A stock trading bot can be used to help you make more informed investment decisions, by taking the emotion out of the stock market.

3. There are a number of different stock trading bots available, and each has its own advantages and disadvantages.

4. It’s important to choose the right stock trading bot for your needs, and to research which one is best for you.

List of the Best 6 Trading Bots for Stocks

There are a number of different trading bots available on the market today. This article will list some of the best trading bots for stock investing.

First, we’ll discuss the holy trinity of stock trading bots: Market-making bots, arbitrage bots, and day trading bots.

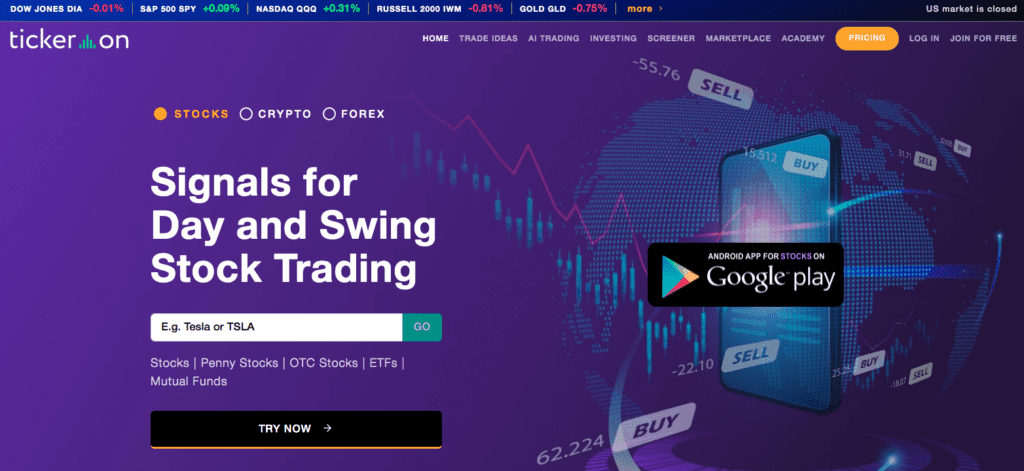

1. Tickeron

Tickeron Trading Bots is a software trading bot. With the help of our sophisticated trading strategies, Tickeron bots consistently make money while minimizing human errors.

Tickeron Trading Bots provides a unique trading bot service for the Stocks market. The Tickeron team provides its users with high-end tools and services to make Stocks more accessible and easier to buy.

2. Tradetron

4. Trafe Ideas

5. Streak

Types of Trading Bots

These three types of bots are essential for any stock trader.

1. Market-making bots are responsible for buying and selling stocks on the exchanges. They help to stabilize prices and keep the markets orderly.

2. Arbitrage bots search for opportunities to make profits by buying low and selling high.

3. Day trading bots are designed for short-term investment purposes. They buy and sell stocks quickly in order to make profits.

Next, we’ll look at technical analysis tools. Technical analysis is the study of charts and patterns to predict future movements in prices. There are many different types of technical indicators that can be used for this purpose.

Last, we’ll discuss portfolio management tools. A portfolio manager is responsible for building a diversified stock portfolio that meets your investment goals.

They help you to track your progress towards your investment goals, and make changes to your stock portfolio as needed.

Reasons to use a Stock Trading Bot

There are a lot of reasons to use a stock trading bot. First, stock trading bots can help you keep track of your portfolio more efficiently.

They can also help you make better investment decisions by automatically trading stocks according to a predefined plan.

Another reason to use a stock trading bot is that it can reduce the time required to make trades. By using a stock trading bot, you can avoid the human mistakes that often result in losses.

Finally, stock trading bots can help you avoid emotional selling and buying. They can also help you stay disciplined when investing in stocks.

Benefits of using a Stock Trading Bot

There are a number of benefits to using a stock trading bot. First, they can help you automate your trading process. This can help you get more accurate stock price predictions and make more informed investment decisions.

Second, stock trading bots can help you reduce the amount of time you need to spend on your trade. They can take care of all the tedious tasks involved in buying and selling stocks, such as scheduling your trades, analyzing market data, and making buys and sell orders. This can save you a lot of time and money.

Third, stock trading bots can help you improve your stock market skills. By using a bot, you can focus on learning how to trade rather than worrying about the technical aspects of the market. This can give you a significant edge over other traders.

Finally, stock trading bots are monitored 24/7 by professional traders. This means that they are always available to help you make informed investment decisions.

Pros and Cons of Stock Trading Bots

Stock trading bots are becoming increasingly popular in the stock market. They can help you make more accurate investment decisions and achieve better returns.

However, there are also some cons to consider before investing in a stock trading bot. Here are 5 Pros and 3 Cons of stock trading bots.

PROS:

1. They Can Automate Your Trading Processes:

A stock trading bot can automate your entire trading process. This means that you won’t have to spend hours researching individual stocks and making investment decisions. Instead, the bot will do all the work for you.

2. They Can Provide Better Returns Than Human Traders:

Stock trading bots can provide better returns than human traders. This is because they are able to make more accurate investment decisions and trade faster than humans.

3. They Are Reliable and Safe:

Stock trading bots are reliable and safe investments. They protect your money by automatically selling assets when they reach their predetermined sell points, and they never lose money due to human error or unexpected market conditions.

CONS:

1. They May Not Be Right for Everyone:

Some people may not be comfortable with automated investments. If you are unsure about using a stock trading bot, you can always consult a financial advisor or review the trading program for more information.

2. They May Not Work for all Investors:

Stock trading bots are not ideal for all investors or market conditions. If you are running low on funds and need to sell most of your assets to continue making investments, using a stock trading bot is not the best strategy.

Stock Trading Bot is a great choice for those who have time and money on hand to invest in stocks but don’t want to deal with the complexity or randomness of human traders.

Conclusion

It can be tough to make money in the stock market, but there are a few simple strategies you can use to help boost your chances.

In this article, we’ll take a look at some of the best trading bots available and show you how they can help you make money in the stock market.

Whether you’re a beginner or an experienced trader, these bots can help you get ahead of the competition and increase your profits.