WHAT IS MOT?

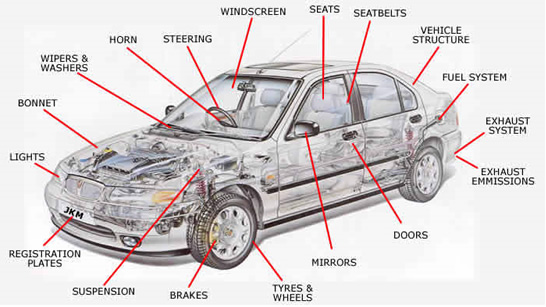

The Department for Transport, of the United Kingdom was long back known as the Ministry of Transport (MOT). For the first time in 1960, the erstwhile MOT, with a view of keeping the road and vehicle owners safe, came out with a rule. According to this rule, every vehicle had to mandatorily test the brakes, lights and steering system of their cars once in a year to ensure safety. This rule generally came to be known as MOT.

This rule over the years has seen lots of modification and revision and even new vehicles, which are 3years old and above have to be mandatorily tested for Vehicle safety and Road Worthiness.

Around 20000, local garages throughout Great Britain have been authorized to conduct the MOT test.

Amongst other things, brakes, lights, battery, electrical system, brake system, body, wiring are tested for performance and safety and relevant certificates issued.

All the vehicles are classified into about 7 classes and every class has its own list and process of testing. The MOT test is on a chargeable basis, the charges ranging from 30pounds to 80pounds.

A vehicle that clears its MOT is awarded VT 20 certificate. Failed vehicle gets VT 30 certificate and VT 32 is awarded for advisories. No vehicle can ply on the road without an MOT clearance certificate.

If a vehicle fails an MOT test, it has to reappear for the test within 10 days, after rectifying the shortcomings.

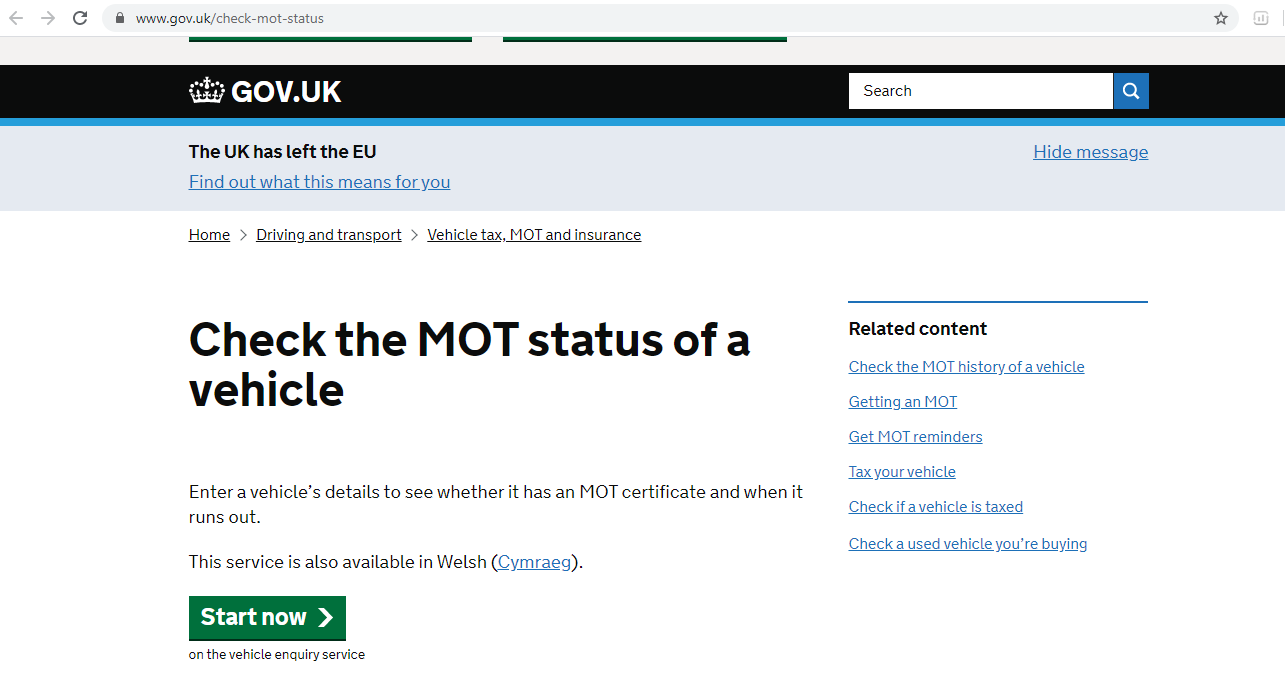

Since MOT is so important, it becomes imperative to keep a track of the certification. To check the current status log on to the site – www.gov.uk/check-mot-status

It will ask you to input the vehicle registration number and the current status can be checked. The next renewal date can also be checked.

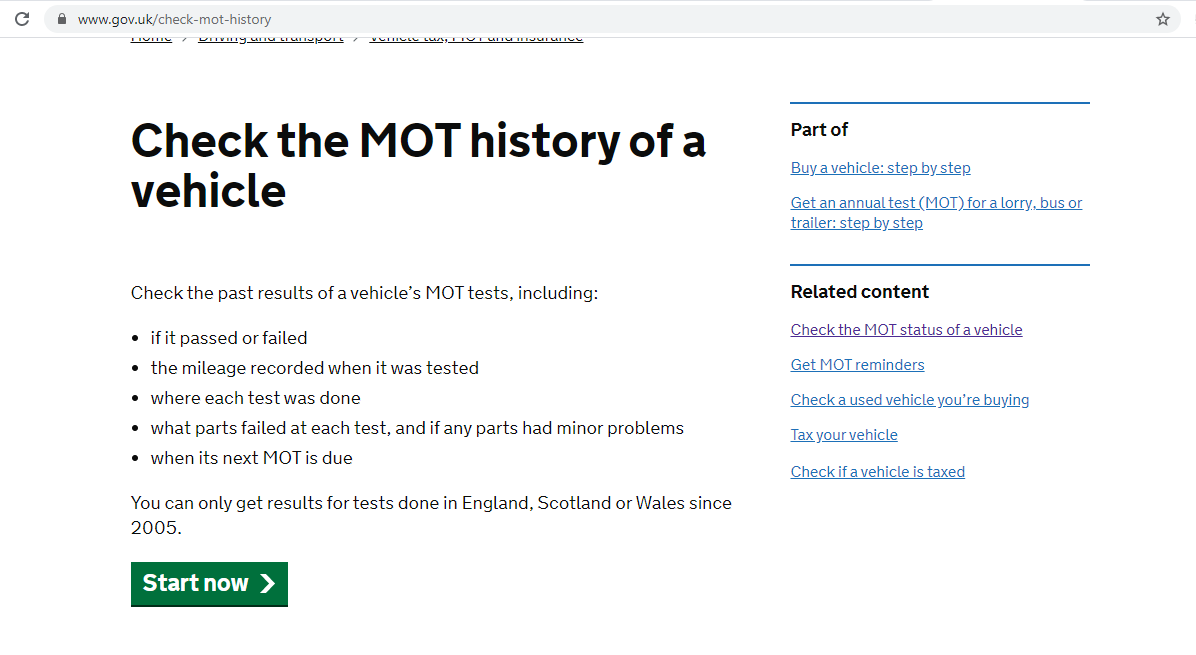

To check the historical data on MOT of any vehicle log on to the site: www.gov.uk/check-mot-history

This site will give you details about the past MOT:

This site will give you details about the past MOT:

- Whether it passed or not,

- Where was the test done

- What parts failed at which test and so on.

This kind of verification is very important when you propose to buy a preowned car.

VEHICLE TAX IN UNITED KINGDOM

The vehicle tax in the United Kingdom is not straightforward and needs to be understood carefully. The car dealer from whom you buy can be a big source of help. There are lots of factors apart from the make and model of the vehicle to determine the tax.

First and foremost there is a different tax structure in the first and subsequent years. The first year tax has an excise component too.

The other factors which go to arrive at the tax value are

- The age of the vehicle

- The categorization of the vehicle

- The fuel used in the vehicle

- The co2 emission figures.

- The physical condition of the owner (physically challenged)

And such more factors go to determine the vehicle tax. Payment of vehicle tax is mandatory in the UK and no vehicle can ply on the road, without paying its due taxes.

If you own a car, you have to keep a track of the vehicle tax due dates and settle it without fail. If you buy or sell a car along with MOT and insurance, the vehicle tax also needs to be cleared and settled.

The first year tax for cars registered after 1 April 2017 is calculated using the above factors. From the 2nd year, the tax is a flat rate of 145 pounds for both petrol and diesel cars.

The owners of hybrid cars pay a lesser amount as these cars are easy on the environment and incentives should be passed on to the owner.

Cars running on electricity, CNG, LPG are taxed 10 pounds less and the rate for them is 135 pounds.

For vehicles which cost more than 40,000 pounds, there is an additional tax of 320 pounds over the standard 145 pounds and that totals out to 465 pounds for diesel and petrol vehicles and 455 pounds for alternative fuel cars.

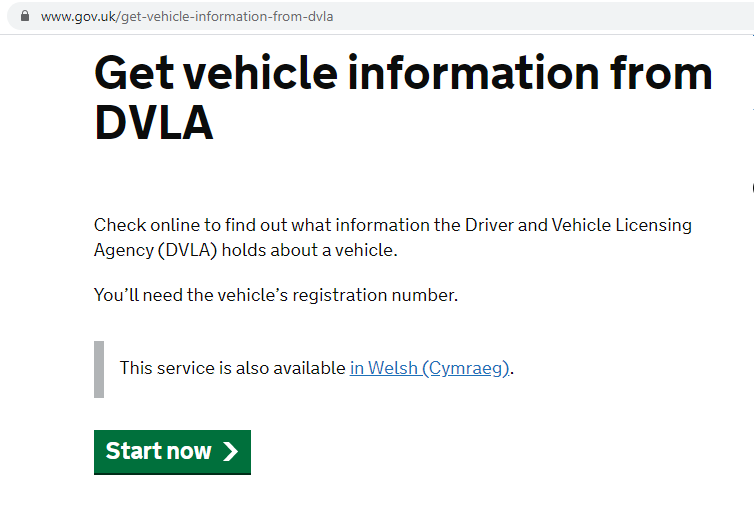

All details about the vehicle tax of any vehicle in the United Kingdom are maintained by the Driver and Vehicle Licensing Agency (DVLA).

To access information on the tax status of any vehicle log on to www.uk.gov/get-vehicle-information-from-dvla

Once the registration number is entered, all details about the tax are disclosed. It also gives details about

Once the registration number is entered, all details about the tax are disclosed. It also gives details about

- Vehicle tax- the expiry and current status

- Details of SORN (Statutory Off Road Notification) status, if any

- MOT expiry

- The vehicle registration date

- V5C logbook issue date

- The year of manufacture of the vehicle

- Weight of the vehicle

- Type of fuel used

- Engine size

- Emission details.

However, if you require details about the current or previous owner of the vehicle you need to write to DVLA.

Certain information out of those mentioned above is also accessible by calling DVLA.