GST or The GST or Goods and Services Tax, is a brand new tax which took effect in India beginning in the year the year 2017. If you’re an online company with customers from India You’ll have to incorporate GST into your marketing and pricing strategies. Below are 10 best GST accounting software choices for businesses operating in India.

The Top GST Billing Software List in India

- Zoho Invoice

- QuickBooks

- Tally ERP 9

- FreshBooks

- Billbooks

1. Zoho Invoice

1. Zoho Invoice

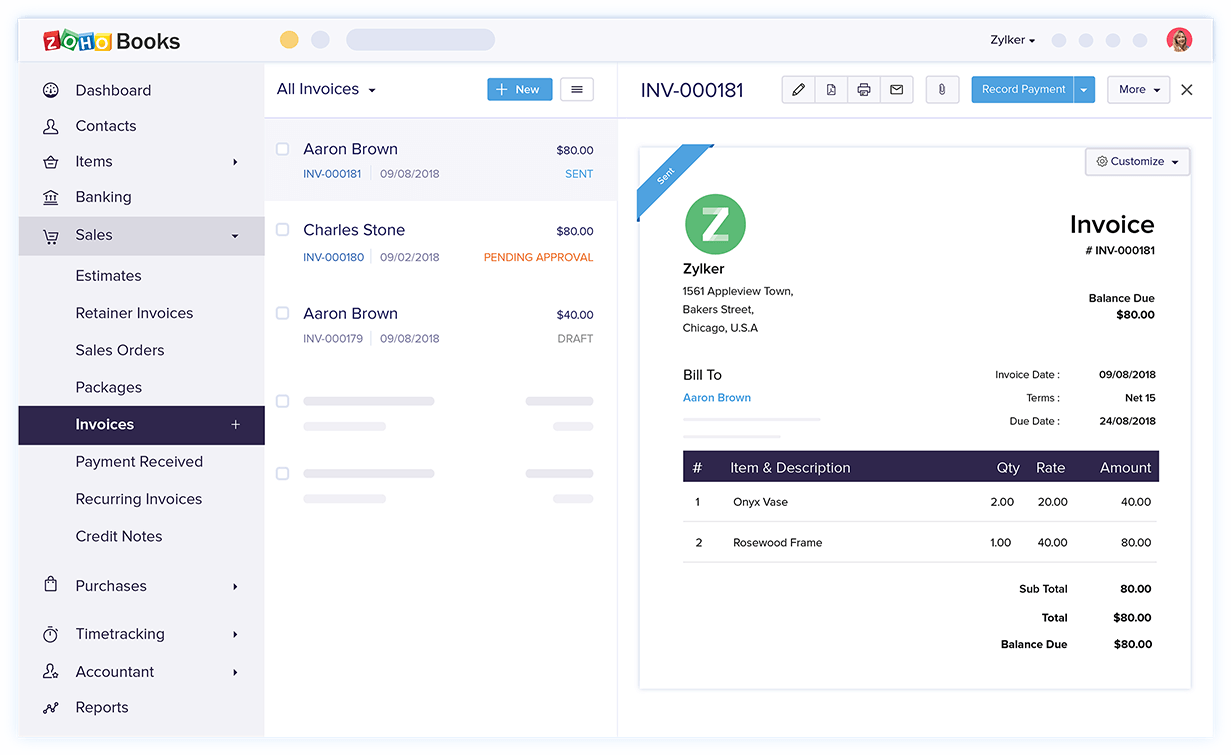

Zoho Invoice is among the top GST softwares that will help companies handle their GST tax and filing requirements. It comes with an easy-to-use interface and extensive features that help businesses meet GST compliance.

Here are the most important aspects that are part of Zoho Invoice:

- Supports multiple currencies

- Capability to design, create, and receive invoices

- Support for tax rates that are multiple

- Create custom fields and reports.

- Integrated with Zoho CRM, it allows you to manage customer information and improve the business processes.

Pros:

- It’s fast and adaptable.

- It is simple to navigate it. The user interface (UI).

- Value in exchange for money.

- Offers tools to create regular invoices, custom invoice templates, reports, and reminders.

- Offers a mobile version of the app with a client portal as well as the dashboard, which displays revenue and sales in the same time in one place.

Cons:

- There are some aspects which could be improved.

- Certain users have reported problems with the program.

2. QuickBooks

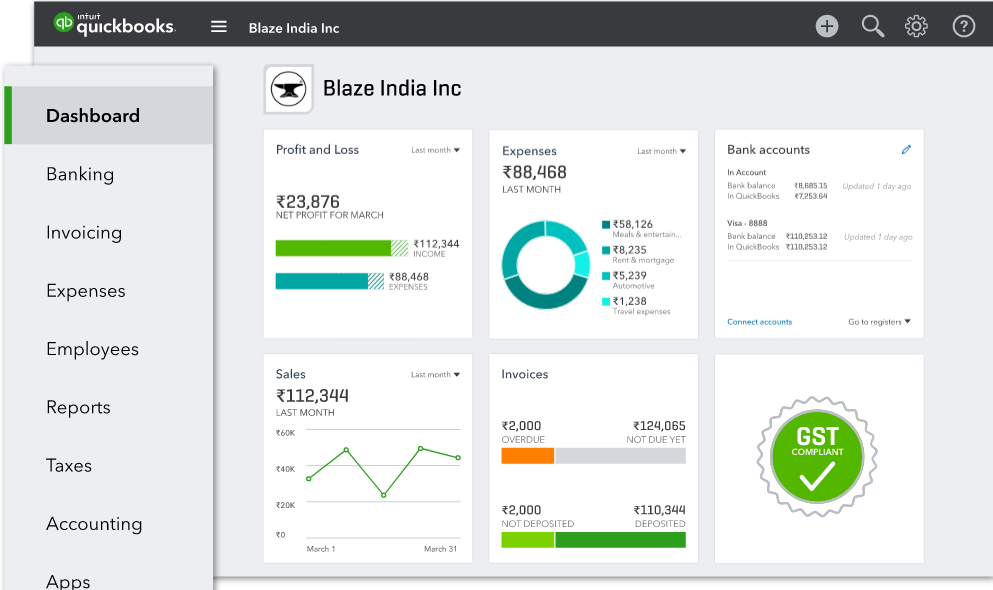

QuickbooksGST software is a complete tax software designed for small businesses. It assists businesses in filing their GST tax returns, manage their GST payments, and keep track on their GST compliance. This blog post, we’ll be discussing QuickBooks GST capabilities, go over the benefits and suggest it to companies.

The features included in QuickBooks GST software

QuickBooks GST software offers many features that can help companies in the GST registration and compliance. Some of the options include:

- Tax filing schedule that can be customized Businesses can select the dates they wish to submit their GST tax returns. QuickBooks will automatically create the proper tax return forms based on the date timeframe. This makes filing your GST returns simple and quick.

- GST calculator QuickBooks comes with a useful GST calculator to help determine your tax liabilities correctly. The calculator allows inputs for your sales figures or purchase value, gross profit margins and so on.

- Reports on GST: QuickBooks offers monthly reports on GST which show the amount of tax you’ve paid, which items were taxed, and so on. These reports are useful to monitor your progress toward GST compliance.

- GST tracking Along with reporting on a monthly basis, QuickBooks also allows businesses to keep track of GST

Pros:

- It’s easy to use and effective.

- Offers excellent accounting reports.

- It can be used with third parties’ applications.

- It’s a good cost-effective.

- Users can cut down on time and money with The QuickBooks GST application.

3. Tally ERP 9

The Tally ERP 9 GST Software is an extensive accounting system that can help businesses track and report on their transactions in a timely quick, accurate, and timely method.

Tally ERP 9 GST software Tally ERP 9 GST application comes with several characteristics that make it a great option for small-scale firms. The key capabilities include:

- Keep track of your losses and profits

- Make sure you are in control of your inventory and other resources

- Analyze your financial data

- Manage and create reports

- Integrate with other systems for business

If you’re in search of an accounting software that will aid you in tracking your profit and losses, control your resources and inventory, analyze your financial data and produce reports, Tally ERP GST 9 software will be the ideal choice for you.

Pros:

- It is simple to setup and effective with regards to data entry.

- It’s cost-effective in comparison to other software available that provide similar features.

- It is able to integrate GST integration, with precise results.

- It’s easy to use.

Cons:

- There are some bugs in the software , and these must be sorted out as soon as possible.

- It’s missing some features that could be beneficial for small businesses.

4. FreshBooks

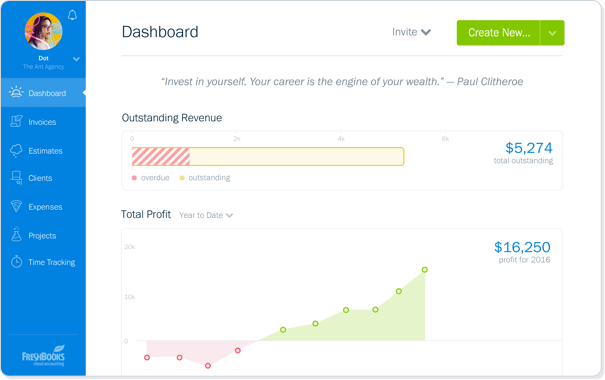

FreshBooks is a cloud-based accounting program which helps businesses manage their operations and finances. Its FreshBooks GST software was designed to assist businesses with the GST requirements of their business.

This FreshBooks GST software allows companies to:

- Report and organize GST transactions

- Create and then send GST invoices

- Manage and track GST refunds

Pros:

- It’s easy to use.

- It is easy to integrate into other systems, tools and software.

- Businesses can modify the software to fit their requirements.

- The software is reliable and effective.

- The GST feature offers businesses a substantial tax deduction.

Cons:

- The software isn’t free.

- The GST functionality is available for a month-long charge for GST. GST function.

- The software might not be appropriate for all companies.

5. Billbooks

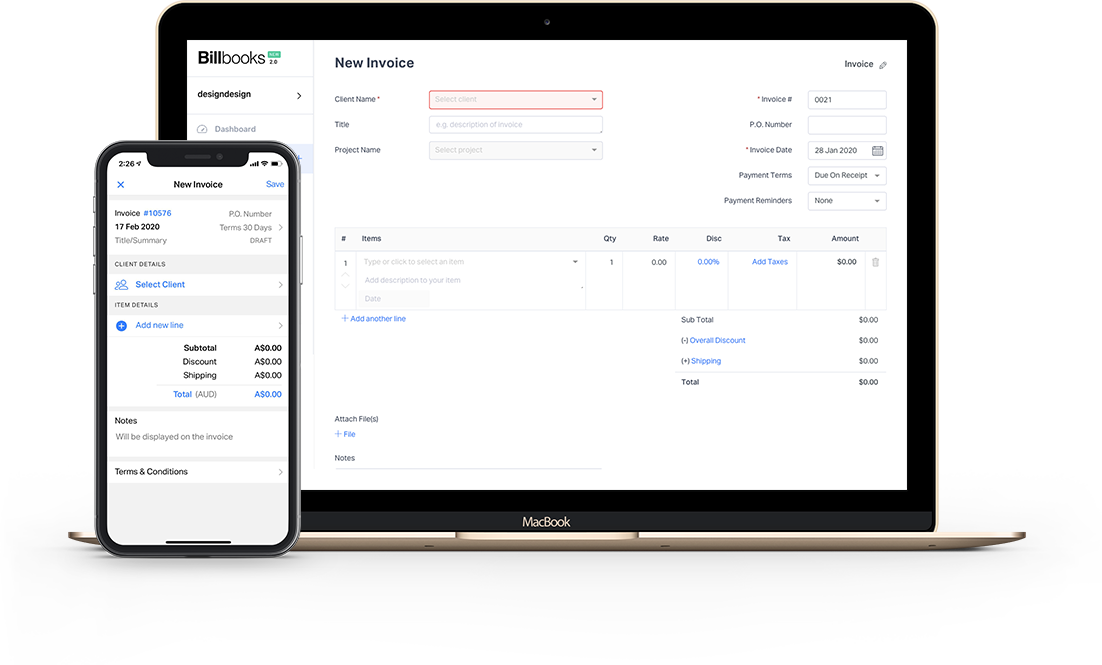

If you’re in the business of printing and selling billbooks, you’ll want to check out Bill Books

If you’re in the business making or marketing billbooks then you should look into Bill Books GST software. It comes with a wide range of features to aid in streamlined operations. Let’s look at a few of the options offered:

- Printing profiles let you alter the way bills are printed, which includes the size of text, font size, and layout.

- Automatic fill can automate fill in the missing value on bills, thereby saving your time and effort.

- The scan-to-PDF feature allows you to convert your scanned documents to PDFs, making it easy for sharing or printing.

- The customizable templates allow you to create new bills easy. No matter if you want a basic bill or a more custom, Billbooks GST software has everything covered.

Pros:

- Support is available 24 hours a day, 7 days a week.

- You can customize invoices.

- Supports multiple currencies.

- Simple to use.

- affordable.

Cons:

- There are a few design options available.

- Not compatible with certain software programs.

What is GST?

GST, or the Goods and Services Tax is a new tax system that came into effect in India on July 1, 2017. It replaces all of the previous taxes, including the income tax, custom duties, and service tax.

The goal of GST is to make it easier for businesses to collect and report their sales and revenues. GST is also designed to reduce the number of double taxation cases that happen in India. Double taxation occurs when one country taxes an entity (such as a business) twice for the same thing.

One of the benefits of using a GST billing software is that it will help you to track your sales and revenues. The software will also help you to calculate your GST liability and pay your taxes correctly.

Read Also:- Best Free/ Paid GST Accounting Software in India

What exactly is GST software?

GST software program on a computer that assists businesses in filing their GST tax returns. It offers a variety of features, like the capability to build and manage your company tax documents and calculate and pay your taxes, and also receive notices regarding tax refunds.

There are a variety of GST software options that are available in India. The most well-known GST Software platforms include QuickBooks, Xero, and MYOB. Each one of these platforms comes with distinctive advantages and features. It is crucial to select the appropriate platform that meets your needs for business.

If you’re looking to learn more about the many options , or choosing a qualified GST software vendor Contact us via [contact_form_idcontact_form_id . We’ll be glad to help you select the best option for your company.

What are the advantages of the use of GST software?

One of the biggest advantages of the use of GST software is it helps tax tracking and filing significantly easier. This is due to the fact that GST software is able to automatically determine and record all data related to your taxes. This includes all of the essential information about your sales and products.

In addition, GST software can also aid you in keeping an eye on your tax liabilities. This is crucial because it helps you detect any errors or discrepancies quickly. Additionally, the software can provide suggestions on how you can reduce the tax burden.

In the end, using GST software makes tax filing more efficient. This is due to the requirement to devote hours trying to gather all relevant information on your own. Instead, the program will do all the work for you.

There are many GST billing software currently available on the market. Each comes with its own distinct advantages and features. It isn’t easy to choose which is best for your company.

To assist you in making an informed choice To help you make an informed decision, we’ve put together an inventory of the best GST bill software available in India. Each of these software programs has been thoroughly evaluated by our expert reviewers and been praised by the public. They’re all reliable and user-friendly. If you’re in search of one of the best GST accounting software for India Our guide will assist you in selecting the best choice.

Conclusion

When it comes time to file your GST returns, it’s essential to have the correct software on hand. Here are ten of the best GST billing software available in India which can assist you in everything from establishing and maintaining your tax records, to the preparation and submission of your tax returns. Check these out if you’re searching for a reliable and cost-effective solution to file your GST tax returns!