Are you looking for something to invest your money in?

Do you want your money to grow exponentially and be safe at the same time?

Or, you want to save money for your future expenses?

If you have heard about stocks and Mutual funds but unfortunately don’t know how to invest in them.

Well, if that is the case, we have something in for you.

We are here with some of the selected and best mutual funds where you can invest and multiply your money.

First, have a quick look at the things that we will be discussing in this article:

Quick Reference

|

Now, we will discuss each of the above-mentioned things in complete detail:

What are Mutual Funds?

A mutual fund is an open-end, returning, and professionally managed investment fund that collects money from many investors to purchase securities.

Mutual funds are “the largest proportion of equity of U.S. corporations.” Mutual fund investors may be retail or organizational in nature. For example, anyone of us can invest in mutual funds in a hassle-free manner.

But as it is a matter of your money, you should know the correct, reliable, and trustworthy mutual funds for investment.

Top 10 Mutual Funds to Invest

Below is the list of the top 10 best, reliable, trustworthy, and high returning mutual funds that will help you invest your money securely and multiply it genuinely.

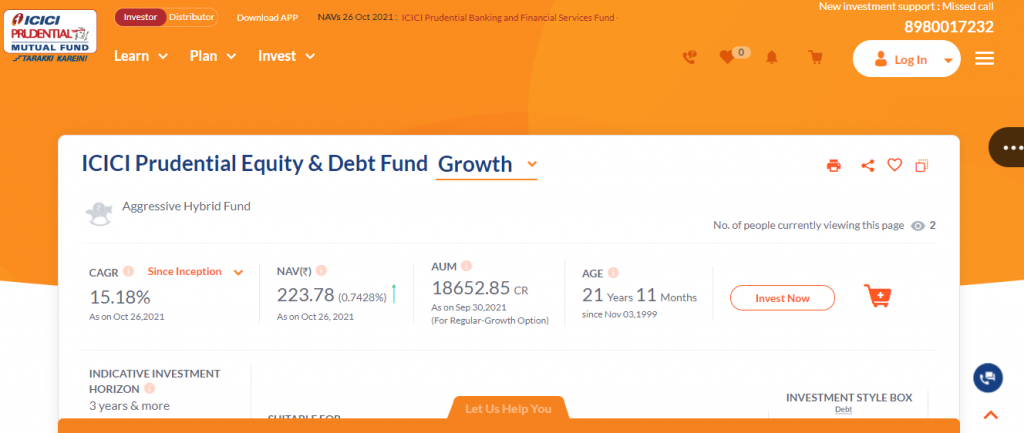

1. ICICI Prudential Equity & Debt Fund – Growth

ICICI Prudential Equity & Debt Fund is one of the most prominent Open-ended Aggressive Hybrid schemes which belongs to ICICI Prudential Mutual Fund House.

The prime investment objective of the fund is to seek the generation of long-term capital appreciation and present income by making an investment in some portfolios that invest invests inequities and other such securities, fixed incomes, and money market securities.

- Annualized Return for 3 Years: 17.75%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 4 Years 4 Months

- Ratings: 4.0/5.0

- Read More

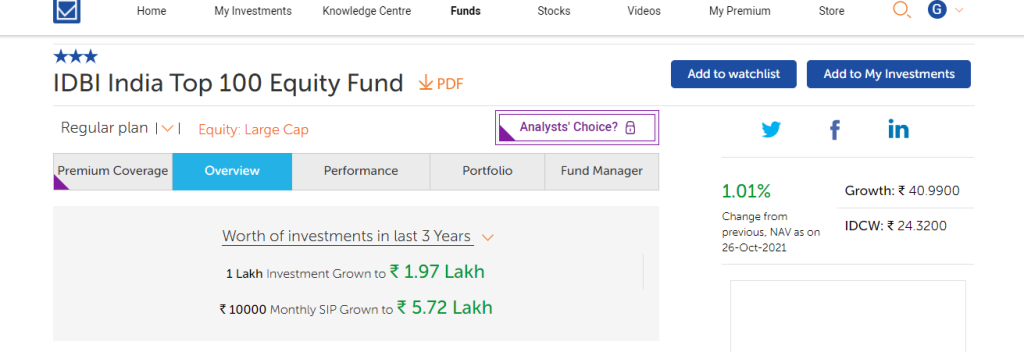

2. IDBI India Top 100 Equity Fund Direct – IDWC

IDBI India Top 100 Equity Fund – Direct Plan is another example of high returning Open-Ended Large Cap Equity schemes which is owned by IDBI Mutual Fund House.

The investment objective of the fund is to provide investors with long-term capital appreciation opportunities by making an investment in equities and market securities predominantly. It has remarkable statistics over the past few years.

- Annualized Return for 3 Years: 22.99%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 5 Years 0 Months

- Ratings: 3.5/5.0

3. CANARA Robeco Bluechip Equity Fund Direct-Growth

Canara Robeco Bluechip Equity Fund – Direct Plan is an Open-Ended Large Cap Equity scheme which is owned by Canara Robeco Mutual Fund House.

The investment objective of the fund is to provide investors with a huge capital appreciation by investing in well-known companies that have large capital values. The name of the fund itself suggests the investment strategy that focuses to make investments in portfolios that would further invest in any of the top 150 stocks ranked on the basis of market capitalization.

Do you want to know what are the top stocks in India according to the price range? Read this post for all information.

- Annualized Return for 3 Years: 23.51%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 4 Years 8 Months

- Ratings: 3.8/5.0

- Read More

If stocks are something that attracts you more, then you can also read this post about the best stocks apps to trade in India.

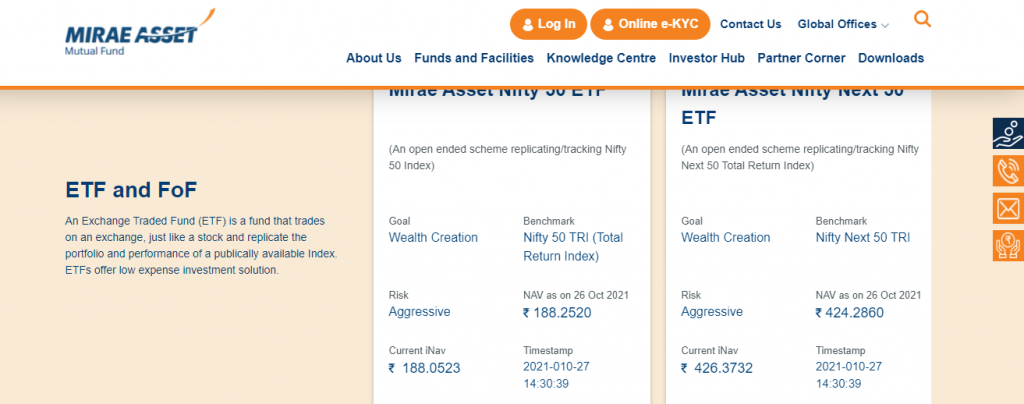

4. MIRAE Asset Large Cap Fund – Direct

MIRAE Asset Large Cap Fund – Direct Plan is again an Open-Ended Large Cap Equity scheme which is owned by MIRAE Asset Mutual Fund House.

The investment approach of the portfolio is centered on participating in high-quality businesses up to a reasonable price and holding the same over an extended period of time so as to maximize the return value.

The scheme focuses on identifying companies that have a sustainable competitive advantage that is stocks which has strong pricing power and are sector leaders.

- Annualized Return for 3 Years: 22.45%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 4 Years 3 Months

- Ratings: 5.0/5.0

- Read More

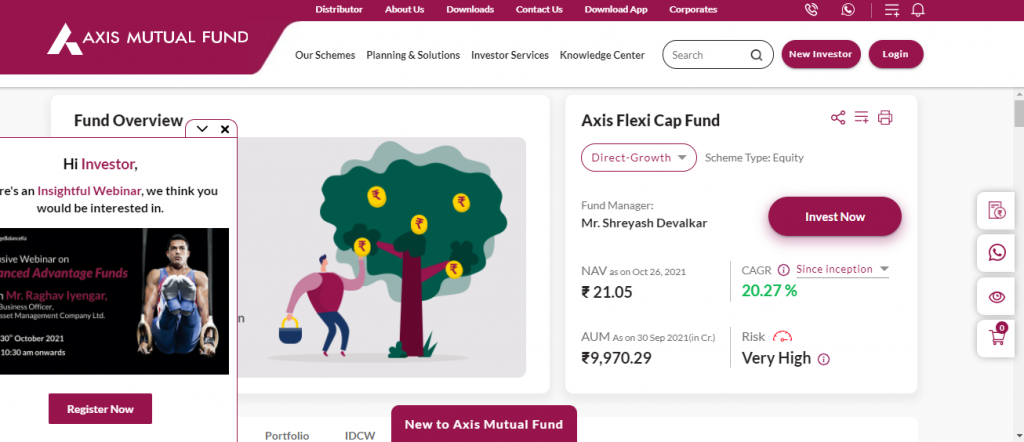

5. AXIS Bluechip Fund Growth

Axis Bluechip Fund is also an Open-Ended Large Cap Equity scheme which is owned by Axis Mutual Fund House and was launched on Jan 05, 2010.

The main investment objective of the fund is that it focuses to generate long-term capital growth and return by making investments in diverse portfolios that consist of equity and equity-related instruments of large-capitalization companies.

- Annualized Return for 3 Years: 21.17%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 4 Years 11 Months

- Ratings: 4.8/5.0

6. PGIM India Flexi Cap Fund Direct – IDCW

PGIM India Flexi Cap Fund – Direct Plan is of Open-Ended Flexi Cap Equity scheme type which is owned by PGIM India Mutual Fund House.

The investment objective of the fund is to generate capital appreciation and income by investing predominantly in a well-managed, active, and diverse portfolio that consists of equity and its related instruments along with derivatives.

- Annualized Return for 3 Years: 30.94%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 4 Years 4 Months

- Ratings: 4.9/5.0

- Read More

7. IIFL Focused Equity Fund Direct-Growth

IIFL Focused Equity Fund – Direct Plan is also an Open-Ended Flexi Cap Equity scheme which is owned by IIFL Mutual Fund House and was launched on Oct 30, 2014.

The investment objective of the fund is to generate a good return and long-term capital appreciation for all the investors by investing in a portfolio of equity and its related securities and instruments.

- Annualized Return for 3 Years: 29.77%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 3 Years 11 Months

- Ratings: 5.0/5.0

- Read More

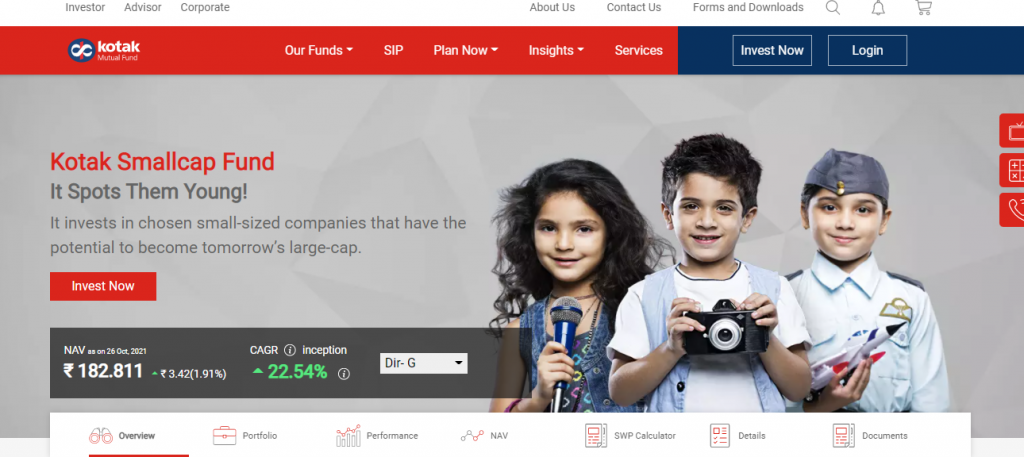

8. Kotak Small Cap Fund Direct – IDWC

Kotak Small Cap Fund – Direct Plan is one of the most popular Open-Ended Small Cap Equity schemes which is owned by Kotak Mahindra Mutual Fund House and was launched on Jan 01, 2013.

The investment objective of the fund is that the scheme focuses on the generation of capital appreciation from a diverse portfolio of equity, market securities, and related securities by predominantly investing in small capitalization companies.

- Annualized Return for 3 Years: 34.11%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 3 Years 7 Months

- Ratings: 4.0/5.0

- Read More

9. Quant Tax Plan-Growth

Quant Tax Plan is an Open-Ended ELSS Equity scheme which is owned by Quant Mutual Fund House and was launched on Apr 01, 2000.

The investment objective of the fund is to generate capital appreciation by making investments in equity shares that have growth potential. It also aims to provide investors with dividends and other pretty income.

- Annualized Return for 3 Years: 32.59%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 4 Years 4 Months

- Ratings: 5.0/5.0

- Read More

10. PGIM India Midcap Opportunities Fund Regular – Growth

PGIM India Midcap Opportunities Fund – Regular Plan is an Open-Ended Mid Cap Equity scheme which is owned by PGIM India Mutual Fund House and was launched on Dec 02, 2013.

The investment objective of the fund is to achieve long-term returns and capital appreciation by making investments in equity and its related instruments and market securities if the middle capital companies.

- Annualized Return for 3 Years: 34.12%

- Suggested Investment Horizon: >3 Years

- Time Taken to Double the Money: 3 Years 9 Months

- Ratings: 5.0/5.0

Frequently Asked Questions (FAQs)

1. What are the top mutual funds?

Ans:- There are thousands of choices while selecting the mutual funds to invest in. But, to choose the right, reliable, trustworthy, and high returning mutual funds has always been a great deal.

In order to make the selection process easier for you, we have brought to you the top mutual funds that will keep your money safe and multiply it genuinely.

2. How to know which mutual fund is right for me?

Ans:- All the mutual funds have a similar purpose. You invest money in them; they invest it in the market and your net amount increments or decrements as per the market’s situation.

So, just open the above links a d visit the websites of the top 10 mutual funds. Select them as per your requirements by looking at the properties and returns and then investing.

3. Are all the mutual funds mentioned above 100% safe and trustworthy?

Ans:- In today’s world, nothing is 100% safe. But, to get the safest is the most important thing. These are some of the most reliable mutual funds.

We cannot promise you a 100% guarantee because mutual funds are subject to market risks but we assure you that these are among the topmost mutual funds to invest your money.